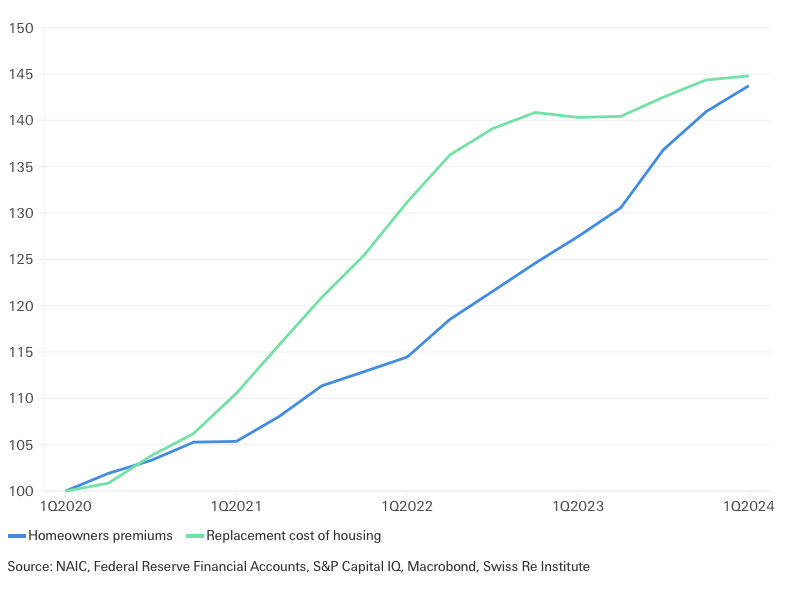

One of the biggest issues facing the insurance industry is that premiums have not kept pace with the replacement cost coverage required to properly insure today’s properties.

Here is an example from just a couple of years ago that shows how the cost to rebuild housing far outstrips premium increases. This is fueled by wage inflation, scarcity of blue-collar labor, inflation in materials, regulatory and local permitting delays, ordinance and law requirements, etc.

Why Can’t You Just Choose Your Own Property Limit?

Sometimes people ask: “Well, that’s ok, I’ll just pick my own property limit. That way, I can manage my premium.” I hate to break it to you, but unfortunately, property replacement cost insurance coverage just doesn’t work this way. Let’s start with an outrageous example to highlight this point. Suppose you own the new Freedom Tower located at 1 World Trade Center. Let’s say it takes 1B USD to rebuild the tower, but you only bought 100,000 of full replacement insurance. Now, in a property that large, you will likely have 100,000 in losses, but you only paid about 1000 in premiums. The problem? Every year, you pay 1,000 dollars, but could claim $100,000 in losses, putting the insurer upside down.

In such a scenario, the insurance company would likely drop you outright, deny the claim, or even impose what is called a “coinsurance penalty.” For example, the penalty mirrors the fact that you low-balled the replacement cost insurance by 6 zeros, or a factor of 1/1,000,000. So, if you put in a 1M loss, they would cut the claim by 1,000,000, and you would just collect 1 dollar. And got forbidden, if the whole Freedom Tower came crashing down, you’d collect the 1B loss times the factor of 1/1,000,000, which is 100,000. So, the point here is to think of the limit you are buying as a slice of an insurance tower, not a stacking of limits.

This is an extreme case, and in reality, many properties are dramatically under-insured by a factor of 2X-10X, highlighting why replacement cost for buildings is such a crucial metric. So, let’s say you have a property with a 1M limit that you bought, but it really takes 5M to rebuild. That is a problem, and you can get dropped or face a claims issue if your replacement cost coverage is too low.

The Role of Inspections in verifying building replacement cost

In an effort to address the national underinsurance crisis, insurance companies are doing inspections on properties to verify the building replacement cost. Some cheaper companies may rely on you or your broker to select the correct limit because they do not want to incur the cost of a human coming out to inspect your property. That still does not alleviate your responsibility to ensure your property is fully insured to value with proper property insurance coverage.

Regular inspections help confirm the replacement cost for buildings aligns with current market trends, labor rates, and material costs—critical data points for ensuring you have the correct replacement cost coverage in place.

How to Make Sure You’re Fully Covered

The bottom line: always ensure your property is insured to the full replacement cost. Work with your agent or broker UPFRONT to double-check that there will not be any claim issues. It is always best if the property rebuild insurance company sends an inspector to verify the limits – that way, you are in compliance and can get accurate replacement cost coverage.

Insurance companies do not like it when properties are under-insured, so do not crack the door open to give them an opening to deny a claim. Under-insuring a property undermines the purchase of your hard-earned money, so it is in your interest to ensure the property insurance coverage limits to rebuild are accurate.

Building Replacement Cost: Why Your Estimate May Be Way Off

Most people and business owners won’t know the true replacement cost of insurance. Ancillary data, such as “Well, my neighbor renovated his property for “X,” is usually not enough data. Insurance companies look at many factors, including:

- Potential delays

- Allowance for ordinary and law

- Local permitting and regulation

- Insurance costs

- Architecture and engineering costs.

Rebuilding a property is sort of like moving. It is usually 2-3 times your initial estimate. Rarely is a rebuild completed within the initial contractor’s estimate of time and money.

Of course, if you work with us, we will ensure your property limits are insured the right way to avoid any issues. If you have a concern about your replacement cost coverages or simply do not know, please reach out. We’ll help assess your property insurance coverage and ensure your building’s replacement cost is calculated accurately. We’d be happy to help.

-Seth Patel

April 20, 2025

Wall Street, NYC

Founder & CEO of Prana Risk

Leave a comment

Did you like this content?